FINOPS

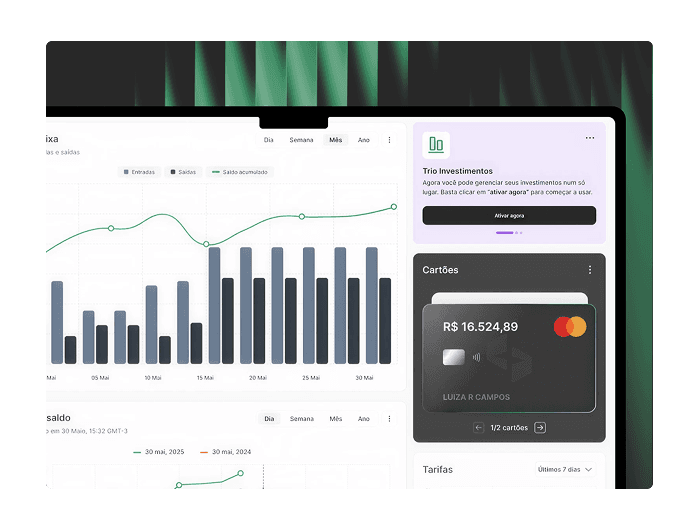

See all data in the smallest detail

Add a management layer over banking infrastructure and gain agility, security and value.

Increase transparency and safety

Automatic Reconciliation

Each transaction includes the necessary data for accurate reconciliation — from virtual account numbers to transaction codes.

Rules of Approval

Set up rules such as automatic return and have your compliance settings based on the specific profiles of each customer.

Automated Treasury

Complete control over payments, scheduling, and cash flow. Automate routines, streamline approvals, and gain predictability with financial management designed to scale with your business.

Recurrence Management

Automate collections seamlessly. Gain complete control over recurring revenue with integrated, secure management tailored to your business model.

FINANCIAL PRODUCT

Auto pilot

Tools and agility for banking in the state of art.

Trio's intelligence can guide your cash flow from bank accounts to investments and credit according to your needs, anticipating your operational moves.

Context: The scale-up recipe

Value the details and make a difference

Your organization will reach greater heights with faster processing, faster communication, and more transparent visualization of information.

CUSTOMIZED CREDIT SOLUTIONS.

A credit structure made for those who move.

At Trio, credit is a growth lever. We offer tailored solutions for receivables anticipation, working capital, and credit origination — all with governance, automation, and regulatory security, without unnecessary bureaucracy.